- Quicken for mac 2017 why don't all future transaction appear in account software#

- Quicken for mac 2017 why don't all future transaction appear in account free#

Where it falls short is in its investment tools. You can set up goals in Mint, things like saving for a down payment or paying off credit card debt and see your progress towards those goals. Bill Tracker allows you to receive notifications of bills due and lets you pay them online. Your transactions sync automatically, so you don’t have to enter things manually. It issues weekly spending summaries, fee alerts, notifications when you get close to and go over a budget category, and your credit score. It’s easy to use and has a lot of convenient features that help monitor your spending.

Quicken for mac 2017 why don't all future transaction appear in account free#

It’s free and an excellent way to budget your money and track every dollar you spend. Mint seems like the natural choice since Intuit owns it. Here is our in-depth Personal Capital review if you want to know more. It uses your financial data to help you plan for retirement and optimize your investment strategy. Personal Capital ticks a lot of boxes towards helping reach your financial goals. You will also get regular summaries of both your spending and your investing portfolio.Īll you have to do is link your online banking accounts – checking, savings, credit, and investment accounts, and Personal Capital does the heavy lifting for you.

Quicken for mac 2017 why don't all future transaction appear in account software#

Personal Capital also has the typical budgeting software features like a list of upcoming bills. The site will also help you set your asset allocation. We’ve talked about how lethal fees can be to your savings, and Personal Capital has a fee analyzer to show how much you’re paying. With Personal Capital, you can see your entirefinancial life in one place and get many powerful financial tools for free. Your overview will show your expenses and your investment portfolio. Whereas some quicken alternatives only focus on spending, Personal Capital also focuses on investment tracking and retirement planning. Personal Capital is our favorite, and it’s free to use. Quicken Alternatives for Personal Accounting 1. If all this sounds like a hassle, check out some of the best alternatives for your money management. If you want to use the Quicken mobile app, you still have to buy the software and sync it with your home computer. The software seems to lag behind the rest of the fintech universe.

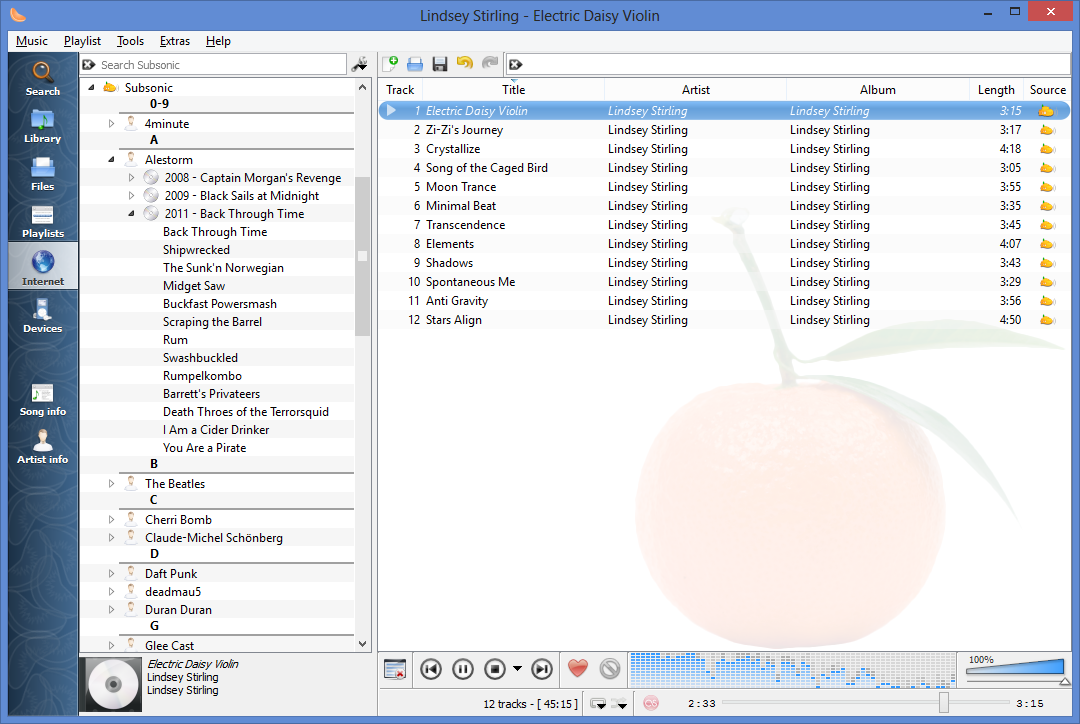

It’s also been immensely underwhelming for many users since HIG Capital bought them in 2016. That desktop-based technology is becoming increasingly outdated, so it’s not outside the realm of possibility that they will discontinue the program. Since Intuit sold Quicken, no one is sure of its future. The basic version allows you to track and pay bills, set up bill alerts, automatically import transactions, categorize spending, create a budget, and generates your credit score. Quicken had a lock on the market until the competition outpriced it. Simply put, if you’re searching for exceptional accounting software that integrates into your money management system, you’ll enjoy this post. This article uncovers 14 Quicken alternatives you can start using today. Or i can log on to your machine to help you.Quicken is no longer the only game in town.

Quicken helps you adjust for this difference later.

Correct the Opening Balance amount if necessary.

Your financial institution may call this the beginning or previous balance. Check the opening balance against your financial institution statement.To access this information, choose Contents from the Quicken Help menu, click the Index tab, and then type reconciling to display a list of related topics. Note: Your Quicken program contains reconciliation-related information. The first time you reconcile an account, the opening balance is taken from the ending balance of your previous statement. Using your account statement, check the amount in the Opening Balance field.From your account register, select the Actions gear icon at the very top of your register ( Ctrl + Shift + N).Enter all of your transactions that occurred since the date of the opening balance transaction.Select the account you want to reconcile on the left in the Account Bar.Hi my name is ***** ***** I will be the expert working with you today to help and resolve the problem you have posted.

0 kommentar(er)

0 kommentar(er)